Let’s Get Bill Gates to Change His Oily Credit Card for a Green One

Bill Gates would tell you we are in danger of living an impoverished life. The idea that we would have to give up our fossil fuel funding credit cards, it’s just a bridge too far. Isn’t it? It turns out that if you want to get your cash rewards, and stop funding fossil fuel banks with your credit cards, almost all of what you would get from a fancy frequent flyer credit card, you can get from a fossil funding free credit card from your local credit union or bank.

I have looked around. I looked at the comparison chart provided by ClimateAction, Compare Credit Card Table. The ClimateAction table does not include all choices. Golden One Credit Union Visa Cash Back+ card was not on the list, but I was encouraged to use the Credit Union for comparison as it had a lot of the features that were highest on the Fossil Funding Free card list.

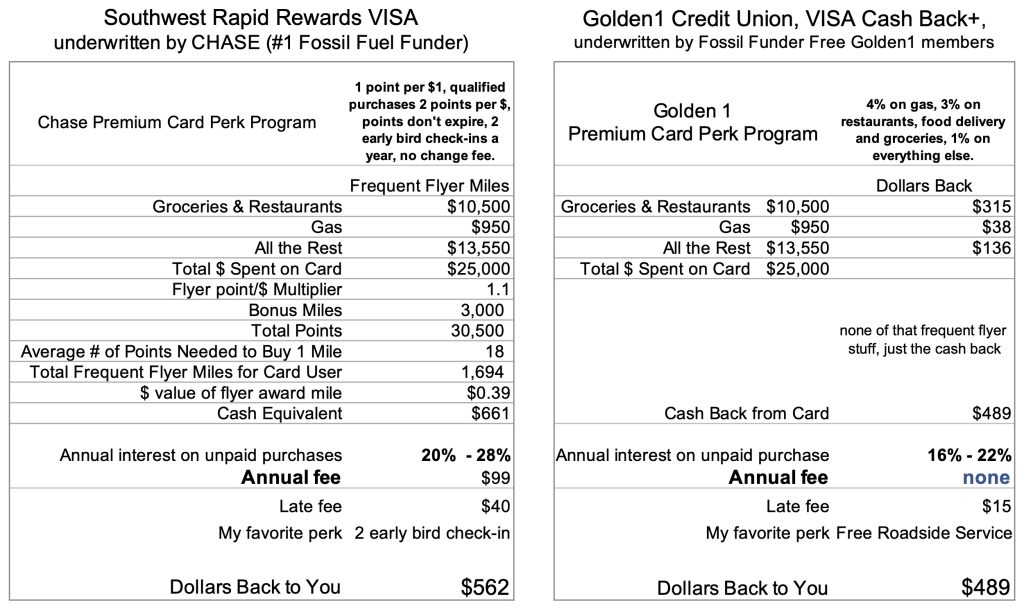

I compared the Golden1 card to Chase bank’s Southwest Rapid Rewards VISA card. Chase is the largest US funder of fossil fuel. My analysis shows that for $25,000 spent through the head-of-household (family card) you might lose about $73 (from $562 to $489) or a reduction of 12% cash back by going with the fossil funding free card. Based on this analysis, that’s within the margin of error.

Today is TH!RD ACT Tuesday, if you’re shopping downtown and you happen to notice a bunch of rabble rousers, of many ages, alongside Chase Bank, Bank of America, and Wells Fargo, you’ll know why. Each of these banks uses record amounts of your deposits for their loans to oil companies around the world. They are the world’s largest funders of fossil fuel, and you’re paying for them with the fees and interest syphoned from your cards.

You can change your credit card and you’re not going to impoverish anyone. In fact, you’re going to put cash in your pocket that is worth every penny of cash back that you get from your frequent flyer miles.

Credit cards pay for your loyalty, they work to get your payments to go through their system. They sell your information, and they get a little something from everyone who sells you something using a credit card reader, Apple Pay, whatever.

In this comparison of the Southwest Chase Visa card and Golden1 Credit Union Visa Cash Back+ card, I gave my imaginary cardholders the exact same amount of money, $25,000, and the money was spent in the exact same way using each card.

I went to some trouble to figure out how much frequent flier points were worth in dollars. If you are not familiar with a frequent flyer credit card, you get points for the dollars you use on the card.

You have to go through a number of steps to get from points to dollars and at the end of day, after all that work, I found the difference between the cash back and the value of the frequent flier miles is less than 12%. You want to watch for annual fees and you want to watch for your ability to use the card outside of the US. The Southwest Chase Rapid Rewards VISA charges $99 a year and the Golden1 VISA Cash Rewards+ charges $0. Both can be used oversees.

The point of this analysis was to show that you don’t need to go to a big bank to get good cash back from your credit card purchases. You can go to a local bank who’s not for funding fossil fuel and do just fine. Bill Gates will not look down on you and the young people in your life will appreciate you a lot. And just maybe you won’t fly quite as much and that’s not bad either.

You can stop here as the rest of this is for those who want to understand where the numbers came from so they can repeat this analysis, doing so will add to the card choices and to the fun.

Frequent Flyer Dollar Value Analysis

Points are accumulated at a little bit over one point per dollar spent on the card. I used 1.1 point per dollar spent. The Chase frequent flyer card delivers 3,000 points annually just for having the card. With a total $25,000 annual expenditure (for a household of two adults and perhaps one child) I came up with a total of 30,500 points. (Referring to the table might help.) I did not consider sign-up bonuses for any card.

To get to a total dollar value for the points you have to have two other values: the average number of points needed to buy 1 air mile, and the cost of 1 air mile. Based on a survey of the number of points needed to travel distances between cities, such as Baltimore to San Diego and Las Vegas to LA, and the cost of that travel, I was able to come up with the average number of points needed to buy 1 mile of airline travel, and the cost of 1 mile of that travel. That’s right, I went back-and-forth through the Southwest Rapid Rewards system to observe the various points and dollars needed to buy flights 30 days in advance. Not scientific, but in the ballpark.

I came up with 18 points to buy 1 mile and the value of that airline mile being $.39 (which is eerily similar to the federal deduction for unreimbursed miles traveled by auto). The value of a mile depends a lot on your choice of tiered prices for lowest cost “Want to Get Away” seats and Business Class seats. I picked a combination of high, lowest and medium tiers and averaged them. For those of you thinking globally if you were to divide .39 by 18 you get 2% which is just about what credit cards give you back in cash (or equivalent value) generally.

All cards are not the same. They’re not underwritten by the same institutions with the same business ethos. And I’ll pick on Bill Gates again. People who try to live within their means are noble and people who ignore and discount every effort to create a livable planet have a lot to answer for. Change your credit card. It’s something you can do to move the needle toward a fossil fuel free future. There are credit unions and banks underwriting credit cards to keep you and the planet whole. Lose your Chase, Wells, Citi and Bank of America Cards.